401(k) Plan Overview

The 401(k) Plan makes it easy to save for retirement. Start investing in your future — and yourself — today with help from the 401(k) Plan and Fidelity. The Plan offers you a range of options to help you meet your investment goals. Complete descriptions of the Plan’s investment options and their performance, as well as planning tools to help you choose an appropriate mix, are available online at Fidelity.

Company Match

For each dollar you save in the Newell Brands 401k Plan Savings Plan (401(k), Newell Brands matches dollar to dollar up to a maximum of 6% for non-union employees and 4% for Muncie Union employees. At the end of the year, Newell performs a true-up to ensure you have received the full employer match. View the SPDs attached below to learn more.

100% Vesting

Every dollar you or Newell Brands contributes to your 401(k) account is yours. There is no vesting schedule.

Investment Line-up

The 401(k) Plan offers Target Date funds to manage your investments for you based on your estimated retirement date. The 401(k) Plan also offers self-directed brokerage accounts to allow you to manage your investments on your own. In addition, the 401(k) Plan has several best-in-class funds with low investment fees to choose from and you have the option to invest in Newell Brands Stock Fund.

Automatic Enrollment

New hires will be automatically* enrolled in the 401(k) Plan after 30 days at a 3% contribution rate.

*The following groups are not eligible for automatic enrollment. Please refer to your summary plan description to learn about your eligibility period:

Retail Employee of Yankee Candle Company and Temporary employees

Long-Term Part-Time Employees

Catch- Up Contributions

If you're age 50 or older and earned more than $145,000 in the previous calendar year, any additional “catch-up” contributions to your 401(k) must be made to a Roth account.

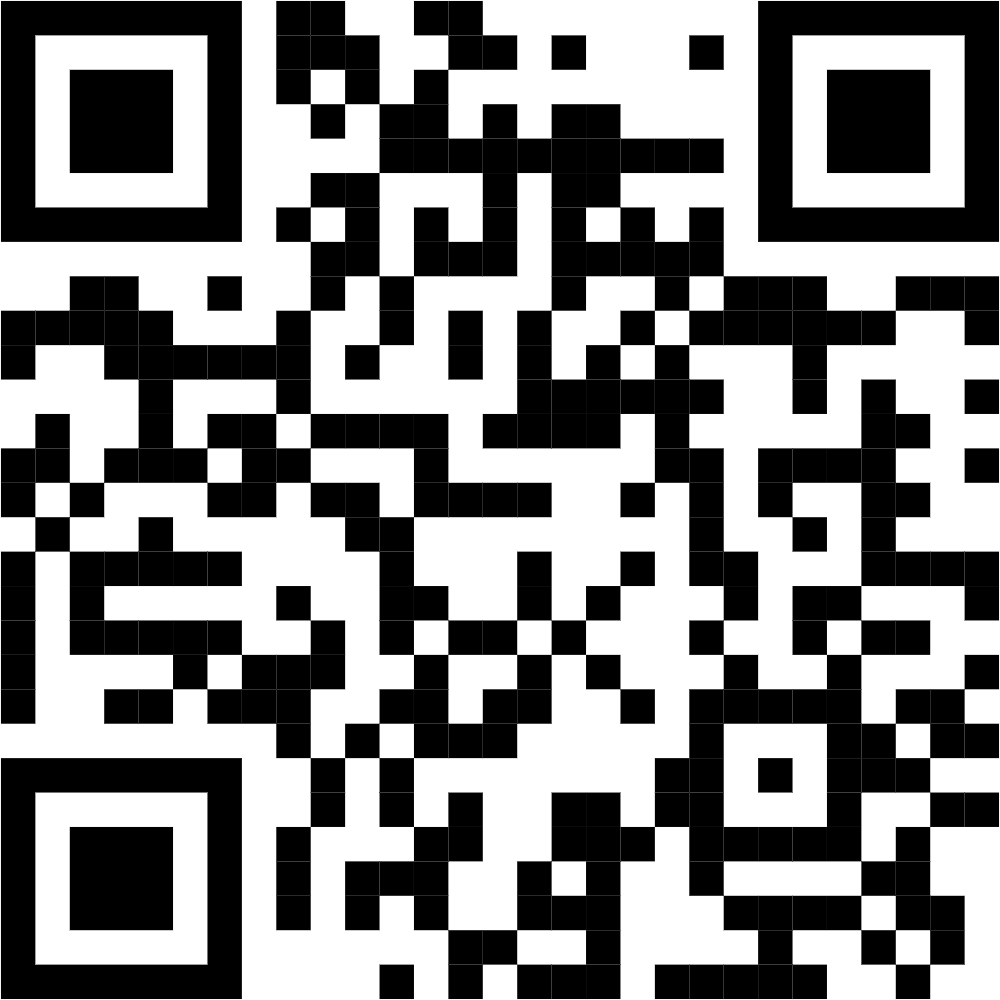

Experience the NetBenefits® App

You can manage your employee benefits from your mobile device. From scanning and sending documents to monitoring your balances and goals, it’s all right there. Learn more at Fidelity.com/NetBenefitsApp.

FAQs

When can I enroll in the 401(k) plan?

New Hires: You can enroll within 7-10 business days following your date of hire. Learn more in the NetBenefits Overview. If you already have an existing Fidelity Account, use that same login information. Otherwise, select Register Now and follow the instructions to create a username and password.

Can I make changes to my contribution amount throughout the year?

You can change your contribution in the 401(k) plan at any time during the year. To change your contribution, visit Fidelity online or on the NetBenefits app.

What are the contribution limits for 2025?

The IRS contribution limits apply to the total of the pre-tax contributions and after-tax Roth contributions. In 2025, the IRS limits are $23,500 in regular contributions and an additional $7,500 in catch-up for age 50 and older, and $11,250 for those age 60-63.

How do I add/review/update my beneficiary designation?

You can make changes to your beneficiary designation by visiting Fidelity online or on the NetBenefits app.

How do I complete the Financial Wellness Checkup?

When you take the Financial Wellness Checkup, you get a clear view of where you stand. You’ll find tips on how to make every dollar count and insights to help you understand your spending, create a plan, and track progress toward your goals— all with personalized insights to fit your life. Visit Fidelity to complete the wellness checkup.

Get help with the following:

• Balancing saving and spending

• Preparing for the unexpected

• Saving for retirement

• Doing more with what you have

Learn More:

Visit netbenefits.com/newellbrands to learn more about the 401(k) Employee Savings Plan. You can contact Fidelity at 833-252-2244 from 8:30 a.m. to 8:30 p.m. ET, Monday–Friday.